About NorthOne

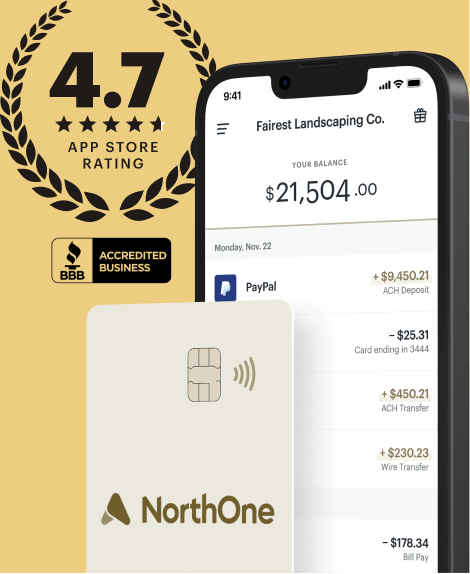

NorthOne is a simple and fast Business Deposit Account. We help builders and makers manage their money by making banking effortless.

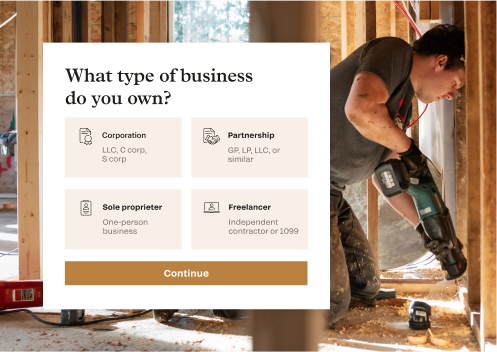

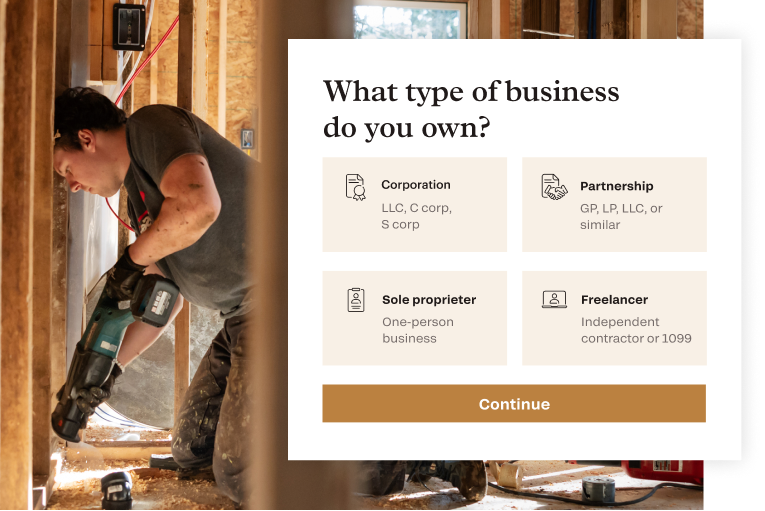

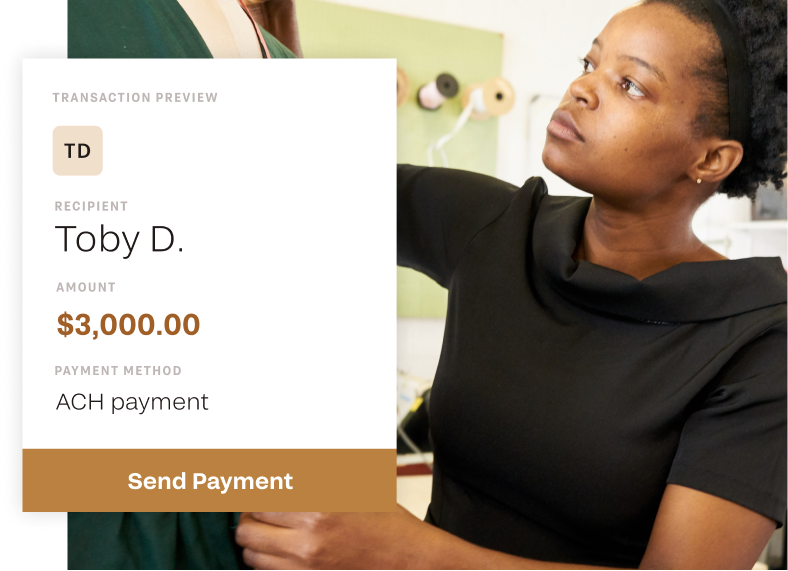

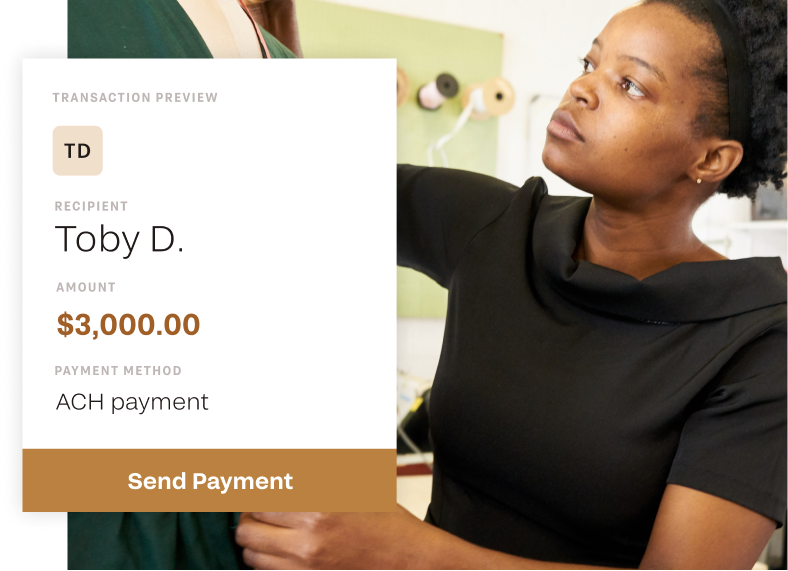

Opening a NorthOne Account is easy—it takes a few minutes to open a Deposit Account. Get access to mobile ACH, wires, deposit funds from approved checks1, and withdraw cash from any MoneyPass ATM nationwide2.

Through our app, you can get insight into your business’ revenue and spending. You have full control and can run your business from anywhere in the world.

With the capabilities of a full Deposit Account in the palm of your hands, NorthOne’s banking experience allows you to save time and money. We automate the time-consuming tasks required for you to close your books at the end of each month.

Our History

NorthOne started when we asked ourselves how we could make small business owners more successful. We set out to create a Deposit Account that solves real problems. From day one to today, our mission has been to make the financial system more inclusive and rebalance the economy from the bottom up.

An Idea

NorthOne was founded in 2017 by Eytan Bensoussan and Justin Adler. There was a whiteboard. Dozens of post-it notes. Late nights. Gallons of coffee. And the hope that we could create a banking experience worthy of today's business builders.

Collectively Made

We interviewed thousands of small business owners from across America in our first year alone. When we heard from them that traditional banks never listen, we listened harder. All of our conversations in coffee shops, diners, and workshops helped us craft a banking app that worked for business owners.

Connecting the Dots

Our dedicated team worked long into the night for months on end. We found a small army of like-minded partners, experts, and advisors, and we all worked tirelessly to bring NorthOne to life. The whole time repeating the words that still welcome new customers to NorthOne: Let’s get to work.

NorthOne Today

NorthOne launched to the public in August 2019. Our story, like this timeline, is still being written each day. But one thing stays true: we work hard, fast, and smart.

Our mission

Our mission is to eliminate financial administration for business owners like you so you’re able to focus on what really matters: growing a successful business.

Our banking app is simple to use and accessible on your mobile device because we believe banking should work for you. We take pride in being radically transparent—by providing clear and honest communication, you’ll never be surprised or confused by unknown fees or complicated language.

Our team

Our goal is to change the way that small businesses and freelancers think around banking and finance. At NorthOne, we’re proud to have a team with diverse work experiences, including owning and being a part of small businesses. From banking, retail, technology, and more, our team reflects the diversity of our clients, which allow us to provide the best mobile banking experience used by all types of businesses across America.

Our team builds technology that makes financial management accessible and affordable. We believe that better banking products can make the whole financial system more inclusive. Do you believe in this too? We want to hear from you.

SECURITY, PRIVACY & LEGAL

¹NorthOne has a Monthly Account Fee. There are additional fees for sending and receiving domestic wires. See the Deposit Account Agreement for details.

²Additional ATM fees may be charged by 3rd party ATMs or ATM owner.

⁶Our Customer Care Team is here to help Monday to Friday, 8AM to 9PM ET, and Saturday to Sunday, 9AM to 6PM ET (excluding December 25th). Send us a message through the mobile app chat, our website, or email us at support@northone.com.

© 2022 NorthOne. All Rights Reserved.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with this card program.

Banking Services provided by The Bancorp Bank, N.A., Member FDIC. The NorthOne Mastercard® Small Business Debit Card is issued by The Bancorp Bank, N.A. pursuant to license by Mastercard International Incorporated and may be used everywhere Debit Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. The Bancorp Bank, N.A. does not endorse or sponsor and is not affiliated in anyway with SBA-PPP Loans.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an Account. What this means for you: When you open an Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents.